Taxation vs. Debt: Is Ghana making the Right Decision to revive a Post COVID Economy?

As cited by the International Monetary Fund (IMF), the coronavirus pandemic has instigated a global economic downturn that the world has never experienced since the Great Depression. According to available statistics, not even the strongest of economies have been able to withstand the shocks associated with this economic downturn caused by the Pandemic. Just like most African economies, the coronavirus pandemic hit hard on the Ghanaian economy. As of 12th March 2021, thus a year after the first coronavirus case was recorded in the country, Ghana has already recorded a total confirmed case of 86,973 and 656 deaths.

Even before the first case was recorded in Ghana, a $US100 million coronavirus preparedness and response plan were announced by the government. Economically sustainable measures such as a GH¢1 billion Coronavirus Alleviation Program Business Support Scheme (CAPBuSS) seeking to provide support to SMEs and the offering of tax deferment periods to some corporations and Ghc 100 billion GhanaCARES /Obatanpa program were further initiated. The government as well spent an estimated amount of Ghc40m feeding program for the highly vulnerable, free distribution of Personal Protection Equipment (PPE) and absorbed utility bills (water and electricity) with specified limits for domestic users for a period of time.

As encouraging as these initiatives may seem, such economic responses were improvised, hence, most were rolled out with the assistance of loan facilities sourced from the IMF, World Bank, and other bilateral economic bodies. Thus, Ghana received an amount of US$1 billion under the Rapid Credit Facility from the IMF and $100 million from the World Bank Group. Consequently, these facilities ballooned the total debt stock of Ghana to GHC291.6 billion as of the end of December 2020. Amidst this, economic activities are expected to slow down as external and domestic demand gain traction; volatile commodity prices, and lingering trade uncertainty due to the pandemic. Whatever the case may be, government intentions are quite clear, as it intends to put the lives of people first and later focus on reviving the economic meltdown caused by the pandemic. However, it is of utmost importance to also question how the government intends to fill the fiscal gaps associated with these economic decisions. Either debt or taxes, the decisions of the government will definitely have an influence on a post-Covid economy. The focus here is to examine the government’s decisions concerning taxes and debt policies for the post- Covid economy as captured by the 2021 national budget. Thus, the focus is to understand the effectiveness of government financial policies in reviving the economy.

In the 2021 national budget, the government highlighted several new taxes as one of the economic strategic plans to revive the economy. The covid-19 health levy, road toll increases, gaming tax, 1% increase in NHIL, 1% increase in VAT flat rate, the financial sector clean-up levy of 5% of profit-before-tax of banks, sanitation, pollution, and the Energy Sector Levy Act (ESLA) brings a total of 5.7% increase in petroleum prices at the pump. In the middle of these numerous taxes lies the people of Ghana, who will be solely responsible for the payments, irrespective of the financial shocks that hit most households.

Although the taxation approach of speedily reviving the economy sounds unconvincing and perhaps unwarranted, the stance of the government to use such a strategy is not surprising. Among most governance systems, the basic economic goals are always centered on using taxes to improve economic development. Tax financing strategies might present the safest haven for economic recovery programs but may have their own economic implications in both the long and short run. Some schools of thought hold the view that a reduction in tax rate will lead to increased economic growth and prosperity, whiles others believe that lower taxes will benefit the rich. In most advanced and capitalist economies, research has shown that lower or high taxes do not necessarily determine growth. Whatever the argument on taxation you choose to put out, revenue mobilization in a country is key, however, should be initiated with strategy and prudent financial principles.

We cannot underestimate the importance of effective revenue mobilization at this critical point. Thus, A well‐functioning revenue system is a necessary condition for strong, sustained, and inclusive economic development. However, the revenue systems in Ghana have fundamental shortcomings. Unlike other African countries that have tax to GDP rates above the world average of 15.34%(2019) (i.e. Kenya 018%, Seychelles – 32%, Cote d’Ivoire – 18%, Rwanda – 15% and South Africa – 28%), Ghana is still hovering around only 12%. Between 2004 – 2019, the percentage of revenue to GDP has loosely fallen from 21.75% to 12.28%. In as much as Ghana is an import-dependent country, the customs, and other import duties percentage to the total tax revenue reduced from 27.5% in 2008 to 12.6% in 2019, yet, the total amount of imports increased from US$ 12.75 billion to 23.71billion within the same period. The informal sector alone, if well managed could increase their revenue contribution from 27% to 50% in the shortest possible time. These facts border on the ineffectiveness of our tax regimes and buttress the point that strong authorities are simply not in place in Ghana to improve the collection of taxes in Ghana.

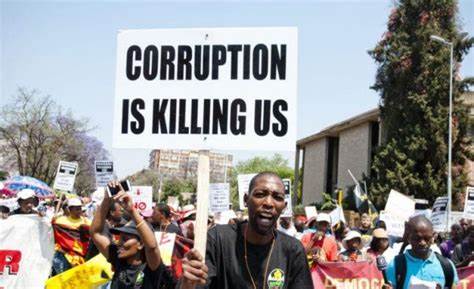

Irrespective of the stimulus packages and tax holidays offered by the government to some sectors as provided in the 2021 budget, the taxation strategy proposed in this critical moment (i.e. at a time where many households have lost their jobs and have no direct or secure source of income) looks too aggressive, but unfortunately, we have to live with it as it has already been passed into law by parliament. Nevertheless, the government should focus more on robust strategies in raking in and increasing internal revenue. Major areas of concern such as corruption and tax invasion, which are key leakages in public finance, could have been considered with stricter measures and policy enforcements. According to a study conducted in 2016 by Integrated Social Development Centre (ISODEC), “Ghana loses close to $2.1 billion annually to tax evasion by corporate groups, individuals, multinationals and organizations operating in the country”. The Tax Justice Coalition in 2018 estimated that “Ghana is losing about $2.7 billion every year to tax evasion and incentives to multinational companies”.

Corruption as well has been “big business” particularly in the public service. A report from the Commission for Human Rights and Administrative Justice (CHRAJ) 2018 revealed that Ghana losses GH¢13.5 billion to corruption every year whiles the Center for Democratic Development (CDD-Ghana)-2019 reported a loss of GHC9.6 billion to corruption within two years. The Ghana Integrity Initiative (GII) in 2019 as well reported that Ghana “loses close to US$3 billion to corruption annually”. Tightening the loops on corruption and tax evasion could have increased government revenue to over $5 billion, the equivalence of about GHC28 billion annually. These revenues could in the long run be realized to cushion the economy and reduce excessive borrowing by the government.

On the issue of debt, our major challenge as a country is our poor debt sustainability strategy in both the short and medium-term. Over the past years, our debt sustainability strategy has still not improved even after graduating from the 3-years IMF extended facility program. As it stands now, the country is classified as a debt distress country by both the IMF and the World Bank in the latest debt sustainability analysis. This literally means that Ghana is accumulating so much debt that it may not be able to repay. A major alarming issue in this current debt hikes is the cost of servicing the debt – interest payment, which has consistently risen over the past 13years (i.e. GHȻ1.1 billion, 3.6% of GDP – 2008 to 36 GHȻ billion, 8.3% of GDP), and ranks Ghana among the countries in Africa with the highest debt services rate. In fact for eight (8) successive years, the total interest payments on the public debt remain bigger than the total government capital expenditure. The ratio of our debt servicing cost and interest payment on public debt to total revenue average 42.3% and 40.2% respectively for the period 2009 – 2019. Basically, this means that, over the past 10years, for every cedi collected in tax revenue, 82.50% was used to service our public debt and its accumulated interest. It is important to also add that, for the first time in over 15 years, the government of Ghana will 2021, spend more money servicing the country’s debts (8.3% of GDP or 32% of total expenditure) than the payment of public sector salaries.

Consequently, this ballooning debt stock against the drastic shortfalls in total revenue poses a significant threat to the Ghanaian economy in both the short, medium and long-run if drastic economic measures are not put in place. There is a need to reiterate that effective and strategic revenue mobilization measures have to be enforced if the tax financing strategy of the public debt would hold. Public debt represents a national and government debt that is owed by a nation’s central government, hence, as a government draws its income from its population, government debt represents an indirect debt on the taxpayer. If an economy grows, it must grow together with its people. Investing debt in the right projects may yield positive results and create enough proceeds to pay back. Ghana needs to be financially disciplined and practice prudent economic-financial management.

Irrespective of the path we choose, whether debt or taxes, it is of utmost importance for the government to strengthen, strategize and resource revenue mobilization institutions to work strictly in accordance with the law. A typical developing economy collects just 15 percent of GDP in taxes, compared with the 40 percent collected by a typical advanced economy. Our challenge as a country is the ability and capacity to effectively mobilize taxes and not necessarily imposing additional ad-valorem taxes at this critical moment. What and whom to tax should go hand in hand with how to tax should be developed with the future implications in mind. The focus should be driven towards expanding the tax base, better compliance, simplifying the tax systems, and stricter enforcement. Measures such as an effective electronic tax filing system (i.e. Technology: perhaps already in place but no effective) will improve efficiency and reduce opportunities for corruption. Oversight and anti-corruption institutions must ensure effective monitoring of public expenditure and evaluation of projects to help reduce the financial leakages in the country. Thus, much economic success could have been achieved if deliberate and drastic measures can be taken to prevent tax evasion and the heightened corruption in the public sector.

Ghana national flag

While there is no one-size-fits-all solution, there are a few lessons that can be drawn from the past statistics to predict what should be expected in the future. Governments with a clear mandate to reform and improve the economic system will often succeed. However, political commitment at the highest level and broad buy-in is highly necessary. Either Debt or Tax, the capacity to build a conducive business environment and efficiently manage an economy that can create additional value for every tax paid by the average citizen should be the utmost concern of the government.

Let me conclude by quoting from one of the letters of Thomas Jefferson, He wrote:

“To preserve our independence, we must not let our rulers load us with perpetual debt. We must make our election between economy and liberty, or profusion and servitude. If we run into such debts, as that we must be taxed in our meat and our drink, in our necessaries and our comforts, in our labors and our amusements, for our callings and our creeds”

Nana Kwame Nkrumah, E (Ph.D. Ch.FE)

Dr. Nkrumah is a Post-Doctoral Associate (PR China) and a Chartered Financial Economist. He is the Lead Partner for Tunani Africa-Ghana (A Think right thank: www.tunaniafricagh.com), a freelance consultant and corporate trainer with a special interest in finance and development economics, innovation systems, SME development, and Occupational safety.

Email: [email protected]

Tel: +233243932107

David Doe Fiergbor is a Business Analyst and a Chartered Economist. He is a personal finance and investment advisor and a business consultant with a special interest in personal financial management and planning, business development, and organizational dynamics management.

Email: [email protected]

Tel: +233249915690