Ghana’s decades of darkness: Finance or Incompetence? The Road Map

In today’s era of industrialization, where all aspects of our lives are so dependent on electricity for the smallest chores like charging a mobile phone to powering industrial units, the idea of life without electricity or a single day with no electricity may be a terrible thought to some people, yet, this is so common and usual among most developing countries. Energy is fundamental to modern life, but 1.3 billion people around the world still live without access to “modern electricity. Statistics from the World Bank show that about 67% of the developing world still goes without household electricity.

In Ghana, “Dumsor” an Akan word that literally means “off and on” is one of the most popular house names used by Ghanaians to describe the persistent and erratic power outages in Ghana. In as much as the term gained popularity during the era of the NDC government under the leadership of President John Dramani Mahama (2012-2016), the issue of erratic power outages has been a long-standing challenge. Thus, irrespective of all efforts to improve the generation capacity of the country, the persistent and erratic power outages continue to be an unrelenting demon devouring its enemies on the battlefield. Currently, over 5million Ghanaians don’t have access to electricity, and those who have access mostly have to deal with the persistent power outages. This may sound torturous and unacceptable if we consider the age of technology and the enormous economic and social benefits access to power fetches for a country.

Decades of Darkness

Evolving from the use of diesel generators, stand-alone electricity supply systems by factories, to the hydro phase, and now to thermal sources, Ghana’s power sector has traveled through a tumultuous trajectory up to its present state. The country’s periods of load shedding can be traced as far back as 1982 till the present. Irrespective, the sector’s reforms of the eighties have brought about competition due to eliminating barriers and instituting a level acting ground for operators. The IPPs have become one of the primary critical stakeholders of the sector in Ghana, which were birthed through the unbundling of the vertically integrated power sector. The three traditional hydro sources dominate the generation mix, controlled by the Volta river authority (VRA), the solar grid-connected plants, and the thermal sources. The nation was anticipated to achieve universal access by 2020, but this may just be one of the numerous magical daydreams as the country is far from meeting this target. Currently, universal access to power is at 84 percent, with rural areas still lagging with one-fifth access and 91% for urban access. The country had transmission and distribution losses of 4.4 percent and 25 percent, correspondingly.

In a study released by ISSER, the findings show that 885 manufacturing firms in Ghana lost GHC250million due to the non-availability of power. Thus, the ramification of the load shedding on the Ghanaian economy is estimated to be about 2 million dollars in a day. The yearly economic damage to the economy due to the load shedding is estimated at 730 million dollars, inferring from the daily costs to the economy, costing the country about 2% to 6% yearly of its gross domestic product.

Astonishingly, Ghana over the past few years has installed enough generation capacity but still faces persistent load shedding, explaining the rationing of power to meet peak demand due to inadequate generation and other supply constraints. The present installed generation capacity is 4,132 megawatts, with the traditional source being 38 percent of the mix, thermal sources with the majority of 61 percent, and renewables about one percent. Because of the proven record to reduce the high costs of power generation while ensuring sustainability, renewables were to form about 10 percent of the generation mix in 2020 of non-hydro sources, according to national targets. This is even amplified by the IRENA costs, where renewables have enjoyed a continued fall in prices globally, making emerging and developing countries save nearly $200B in new renewables power plants built in 2020 onwards comparative to the same capacities from conventional sources. However, the country has barely achieved one percent within the timeframe. This has exacerbated the widening gap of access for the rural dwellers who live in off- grids locations and cannot be served by the national grid. Sadly, these may continue for years until we overpower all constraints impeding the generation capacity.

Financing…

The legendary challenges confronting the power sector of Ghana are primarily financial and, to some extent, managerial challenges.

The discovery of oil and gas in Ghana was expected to aid the country’s power sector to save costs via generating electricity through gas from the oil and gas fields. Thus, gas is considered to be cheaper relative to light sweet crude for electricity generation. But then again this assertion is quite far from reality.

The sector can currently be described as highly insolvent, hence the sector’s high prices of power and the sluggish levels of incomes grappling with the sector. The insolvency of the power utilities is further deepened due to the reduction of tariffs by the Public Utility Commission (PURC) by 17 percent. This has brought about expansion in the energy demand, growing demand by 2,229 MW in the third month of the first quarter in 2018, to 2,433 MW in April in the last month of the first quarter, owning to tariffs reductions and making electricity cheaper than before. Within this same period, it is reported that an estimated $9 billion is required between 2014 and 2019 to leverage further finances to build critical infrastructure in the power sector and modernizing the national grid.

Again, the operational efficiencies and unbearable costs, such as exorbitant fuel prices for thermal plants have culminated in severe financial difficulties for the sector. For instance, Ghana was supposed to import nearly a billion dollars in 2019 to run its thermal plants. This puts a strain on the state’s finances as the government would have spent hard currency importing these fuels from abroad. There also exist high-level costs for installed generation for IPPS and Emergency Power Producers (EPPs). The Karpowership is one of the emergency power plants that cost the country a fortune. As well, high distribution losses due to theft and aging distribution infrastructure vis-à-vis low revenue mobilization due to illegal connections, inefficient billing system, and refusal of bill settlements by the government sector continue to cripple the financial ability of the power sector. As of 2016, the sector suffered a whooping $794 M due to a deficit in revenue mobilization gap. The ECG as one of the power distributors is grappling with liabilities of Ghc 7.6billion at the end of 2017 and also been cited to be a loss-making enterprise since 2011. The Volta River Authority (VRA) on the other hand, for instance, had to resort to external finance from the domestic market to raise money for its fuels, resulting in a debt of $2.3 B in 2017. Such financing decision is a financial yoke on the sector and the country as well, hence, subsequently impede the sector’s ability to function efficiently.

Incompetence…

Farther from the financial challenges facing the power sector, some section Ghanaians have also raised concerns of incompetence; citing gross managerial misconduct by those responsible for the efficient management and supply of power to the people of Ghana. Whether this assertion is right or wrong, there is the need to understand the efficient management of power from two critical perspectives; thus, from the state, institutions managing the industry, such as the Ministry of Energy and the managers of the power utilities.

By the modus of operation, all the utility companies in charge of power distribution in Ghana operate as a state monopoly and are in charge in all phases of power management (i.e. generation, transmission and distribution). Quite recently, a political ineptitude resulted in crafting power purchase agreements that caused financial losses to the state via judgment debts. The failure of the state to scrutinize PPAs due to their parochial interests or reasons best known to them has caused the country fortunes over the past few years. Why should we pay for excess capacity when the surplus is being curtailed, yet the nation bears the cost? That begs the question. Glaringly, this structure or operation system has only led the country to financial losses and mismanagement. Possibly, if we can use the Contract for difference (CDF) approach, we ought to know the kinds of PPAs we enter into. The CDF makes it possible for the generator to receive or make payment less than the reference price, which could be negative or positive given in the Contract. It is a two-pronged approach kind of Contract. With this knowledge, we can avoid the issue of excess capacity and judgment debts. It is important to also emphasize that, the PPAs have legal, finance, and Energy ramifications, hence, there is a need to harmonize roles from the Attorney General’s department, ministry of finance, and Energy in negotiating and signing the PPAs for the country, instead of being done in silos, in case that is the situation.

On the other hand, mismanagement in the country’s power utilities internal settings is another challenge that needs to be reckoned with. The flawed billing system leading to low-cost recovery and the like is one of such management practices. It will surprise you to know that, the country loses a whopping amount of $2.5million monthly due to underutilized energy infrastructure which could be avoided if the equipment is fixed. The disproportion between the financing and investment decision in managing the power sector is really absurd. Reasonable standard operating process procedures must be established and followed by the top management to the bottom, especially regarding financial reporting and accounting. Politicians should not b encouraged to recruit top managers and middle management managers to these power utility companies as it will spring up a free hand to operate in their roles in the public sector.

The RoadMap...

As Christopher Flavin put it “The real potential of electricity lies not in providing social amenities but in stimulating long-term economic development”

The critical concern for Ghana is to improve the financial sustainability of the energy sector, its cash flow, grows its earnings, minimizes its liabilities and reorganizes its liabilities. On the hills of this is steps ought to be taken to advance the utilities’ commercial, technical and functioning capacities. Thus, Ghana has to take steps to cut down the costs of its generation sources since the chunk of the generation comes from thermal sources, which are costly.

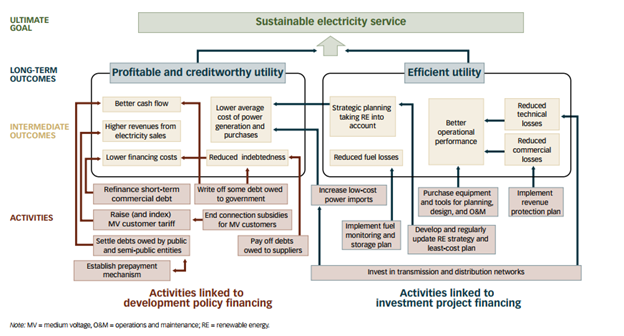

The government can formulate a financial development plan (FDP) that enhances the cash flow and earnings of the utilities and an investment project finance (IPF) approach to create the right environment for the financial viability of the reforms. The IPF index acts to ensure that the various reforms outlined in the transmission and distribution systems are being achieved, such as reducing the costs of the generation mix, increasing revenue performance of the utilities, and growing the shares of RES in the generation mix from the current one 1% to nearly 50% by 2030. Government should endeavour to restructure the liabilities of the utilities, providing concessional funding, etc. Some might exist, but there is the need to ensure they provide the needed results.

Overall, the government has to scale up measures on grid modernization and distributed grid sources like wind and solar and high voltage transmission networks to connect distant renewable energy sources to market centers.

Figure 1. Framework for Transforming the Power electricity sector in Ghana

The figure gives the ideal situation for the operationalization of a profitable and efficient power utility. It lays out the activities involved in developing a finance tool that leads to an efficient power utility and IPF activities that will cut down liabilities of power utilities. From the short term to the long term, Ghana has to focus on increasing the utilities’ cash flow and revenues levels. Also, if the country wants to be efficient, it has to invest strategically in renewables and cut down costly generation sources such as thermal sources.

In conclusion, Ghana lags in renewables generation and the modernization of its grid infrastructure but has advanced in electrification in SSA. The government can solve the power sector challenges if we give it the needed commitment from the authorities that matter since the reforms can be done in the short to medium term. Still, we need to plan in improving the solvency of the power sector via developing better financial instruments and investing in the right generations in enhancing the industry’s financial situation.

Dr. Nkrumah is a Post-Doctoral Research Associate (PR China) and a Certified Chartered Financial Economist. He is the Lead Partner for Tunani Africa-Ghana (A Think right thank: www.tunaniafricagh.com), a freelance consultant and corporate trainer with a special interest in finance and development economics, innovation systems, SME development, health economics and safety ergonomics.

Email: [email protected] Tel: +233243932107

David is a PhD candidate at the Jiangsu University, School of Finance and Economics, China. His research interests are in a low carbon economy, power systems, and energy transition. He has published extensively in energy-related subjects and holds a strong passion for sustainable consumption, hence, daily engages in research focusing on sustainable energy generation and climate change issues.

Email: [email protected] Telephone +8618261968039